By Amy Hoak

Monday, August 30, 2010

More homeowners turn to shorter loan terms

A growing number of homeowners are choosing to pay down their mortgages at a faster rate -- even if it means a substantial jump in their monthly payments.

From January through June, 26% of homeowners who refinanced chose a 15-year fixed-rate mortgage, according to data from CoreLogic, a provider of financial, property and consumer information. During all of 2009, 18.5% of borrowers who refinanced opted for a 15-year term. About 9.4% did so in 2007.

What's prompting the shift to shorter loans? Historically low interest rates for fixed-rate mortgages.

Homeowners are doing the math and realizing that rates have fallen enough so the increase in payment between a new 15-year mortgage and their current loan is no longer unbearable for their budgets, said Bob Walters, chief economist at online lender Quicken Loans.

The average rate on a 15-year fixed-rate mortgage was 3.86% for the week ending Aug. 26, according to Freddie Mac's weekly survey of conforming mortgage rates.

A Change in Thinking

The financial situation of the people capable of refinancing today is a factor in the shift, Walters said. These people typically are homeowners with the best credit and the most equity -- and, therefore, most suited for a shorter-term loan.

But there might be some psychology at work. "We're seeing a different view on debt than maybe we've seen in the past," he said. Today, homeowners are saying, "I really want to pay this off. I'm going to bite the bullet and take the payment and work toward paying this down."

Also, the average rate on a 15-year fixed-rate mortgage is below 4% right now, and having a mortgage rate that starts with a "3" is attractive for people who can afford it, said Leif Thomsen, chief executive of Mortgage Master, a privately owned lender.

It also acts as somewhat of a forced savings account for homeowners, he said, given that the higher payments help pay down the principal at a quicker clip.

This is a huge shift in borrower thinking. "There was a drive a couple of years ago to take out the biggest mortgage that you could and use all of the money you would have otherwise had in the house and put it into stocks and bonds -- to think of your house and mortgage as part of your entire investment portfolio," said Amy Crews Cutts, deputy chief economist for Freddie Mac.

"That worked for people who do investment finance for a living and are good at managing accounts," she said. "But for the average person, debt is a drag on their psyche as well as their overall budget."

Many Americans have reverted to the goal of paying off their house and getting rid of their mortgage, Cutts said.

Doing the Math

Refinancing into a shorter-term mortgage isn't a strategy for everyone, however.

Choosing a shorter term usually means you'll get a better rate -- and you'll pay much less interest over the life of the loan -- but a shorter timeframe ramps up monthly mortgage payments.

[See How to Overcome Refinancing Hurdles]

For example, with a 4.5% interest rate on a 30-year fixed-rate mortgage of $200,000, you would have a monthly payment of $1,015, including principal and interest, Cutts said. The monthly payment jumps to about $1,480 with a 4% interest rate on a 15-year fixed-rate loan.

Of course, if the refinancing borrower's current 30-year loan has a higher rate, the difference between the monthly payments could be less. Still, you should count on some increase in monthly payments.

In general, Walters said, those who choose 15-year fixed-rate mortgages are older and have more equity and less debt than other folks. They also earn higher incomes and don't have some of the added expenses that younger homeowners typically do.

"People who are taking these loans are financially stable and can afford the payments, but at the same time are planning on staying in their home for an extended period of time," Thomsen said.

Walters said homeowners shouldn't take on a 15-year fixed-rate mortgage unless they have substantial savings, including at least a year's worth of living expenses in liquid accounts.

Also, he recommends having a debt-to-income ratio below 35%. So if you have a gross salary of $5,700 per month, for instance, your monthly debt -- including any mortgage payments, taxes, insurance, homeowners-association dues as well as auto and student loans and credit-card debt -- would have to be a max of $1,995 to get a 35% ratio.

Make That Extra Payment

Borrowers who don't meet those standards, or are worried about future loss of income, might be better served taking a longer-term mortgage but making extra payments to the principal to pay off the loan faster, Walters said.

For instance, if you refinance a $200,000 mortgage into a 30-year loan with a 4.5% rate, and then apply $100 of the savings to the principal payment each month, you'd save $31,700 in interest over the life of the loan, Cutts said. And you would pay off the mortgage in 25 years, instead of 30, she said.

What's more, you would have the flexibility of not paying that $100 in months when money gets tight. "Maybe today you're feeling flush with money. Maybe you're worried in the future that income might change," Cutts said. With a 30-year mortgage, you have more flexibility. "Shortening to 15 years is a pretty big bump in payment."

Amy Hoak is a MarketWatch reporter based in Chicago.

Tuesday, August 31, 2010

Sunday, August 29, 2010

Avoid These 5 Used Cars (Plus 5 to Buy)

by Jerry Edgerton

Saturday, August 28, 2010

provided by

Used car shopping used to be a scary maze of breakdown-prone models, but reliability has gained sharply. Auto manufacturing quality and dependability studies have shown steady gains this decade. But exceptions do exist and if you're in the market for a used car, you want to steer clear of them.

More from CBS MoneyWatch.com:

• 6 Big Myths about Gas Mileage

• Made in USA: Best American Cars

• 5 More Reasons to Hate BP

So CBS MoneyWatch.com has compiled a list of used cars to avoid in five categories, focusing on 2007 models-the year from the latest J.D. Power and Associates dependability study. Buying a three-year-old car also lets you shop after the bulk of depreciation has taken place.

To make our list of used-car rejects, a model had to score the minimum two out of five in the J.D. Power "circle ratings" for dependability–a below-average ranking. It also had to be ranked below average as a used car by Consumer Reports in its annual April car issue and online car rankings.

Here are our used cars to avoid, by category, plus better used car alternatives:

Small Used Car to Avoid: Volkswagen New Beetle

Sure, it's adorable, but the 2007 New Beetle is also trouble-prone. Owners who responded to the Consumer Reports reliability survey reported problems with the fuel and electrical systems, the suspension, brakes, power windows, and other power equipment. The convertible model sells on dealers' lots for $17,055, according to Kelley Blue Book at kbb.com.

Small Used Car Alternative: Ford Focus

It may not be as stylish as the Beetle, but it's a lot more reliable. In fact, the Focus got the J.D. Power award as most reliable compact car. Owners of the 2007 Focus who responded to Consumer Reports reported no major trouble spots. And it's much cheaper than the Beetle. The Kelley Blue Book dealer price is $10,905.

Mid-Size Used Car to Avoid: Chrysler Sebring

The 2007 Sebring sedan not only got just two circles from J.D. Power, Consumer Reports reported a laundry list of problems: engine cooling, minor transmission problems, the drive system, suspension, brakes and more. The low $12,365 dealer price isn't worth it.

Mid-Size Used Car Alternative: Buick LaCrosse

Winner of the J.D. Power dependability award in this category, the 2007 LaCrosse got an above-average used-car rating from Consumer Reports. It's a good value at a dealer price for the CX version at $14,430.

Small Used SUV to Avoid: Jeep Wrangler

King of the off-road, the 2007 Wrangler can climb over almost any obstacle except a reliability test. Owners of the two-door version responding to Consumer Reports reported major transmission problems and issues with the electrical system and brakes. And it's selling on dealer lots at a relatively expensive $19,850.

Small Used SUV Alternative: Honda CR-V

A lot less noticeable than a Wrangler, the Honda CR-V is a lot less trouble, too. It won the J.D. Power dependability award in this category and is rated by Consumer Reports as a well-above-average used car prospect. As a used-car buyer, you are on the wrong side of Honda models' strong ability to hold their value. But at a dealer price of $20,980, the four-wheel-drive version of the CR-V is still a decent value.

Mid-Size SUV to Avoid: GMC Acadia

The 2007 Acadia is a good example of the time-honored rule to avoid buying the first year of a model. It not only got a below-average two circles from J.D. Power, it received a much-worse-than-average used car rating from Consumer Reports. CR readers who owned the 2007 reported problems with the drive system, suspension, body integrity and power equipment. In addition, the all-wheel-drive version on dealers' lots is priced at an expensive $28,435, according to Kelly Blue Book.

Mid-Size SUV Alternative-Honda Pilot

One of a handful of mid-size SUVs to get four circles from J.D. Power, the Pilot is rated well-above-average by Consumer Reports. (Its corporate stablemate, the Accord Crosstour, actually won the J.D. Power award. But many reviewers find its modified-sedan style not big enough to provide true SUV cargo or passenger room.) The Pilot is selling for $23,395-some $5,000 less than the GMC Acadia.

Used Minivan to Avoid: Nissan Quest

Never a strong contender in this category, the Quest gets a below-average used car rating from Consumer Reports and two circles from Power. Owners of the 2007 reported problems with the fuel and climate system, brakes and body integrity. The Quest is selling at $17,395.

Used Minivan Alternative: Toyota Sienna

This van gets four J.D. Power circles and an above-average CR used car rating. Not part of the Toyota sudden-acceleration recall, the Sienna is selling at a dealers' price of $20,280 for the CE trim level.

___

Follow Yahoo! Finance on Twitter; become a fan on Facebook.

provided by

Used car shopping used to be a scary maze of breakdown-prone models, but reliability has gained sharply. Auto manufacturing quality and dependability studies have shown steady gains this decade. But exceptions do exist and if you're in the market for a used car, you want to steer clear of them.

More from CBS MoneyWatch.com:

• 6 Big Myths about Gas Mileage

• Made in USA: Best American Cars

• 5 More Reasons to Hate BP

So CBS MoneyWatch.com has compiled a list of used cars to avoid in five categories, focusing on 2007 models-the year from the latest J.D. Power and Associates dependability study. Buying a three-year-old car also lets you shop after the bulk of depreciation has taken place.

To make our list of used-car rejects, a model had to score the minimum two out of five in the J.D. Power "circle ratings" for dependability–a below-average ranking. It also had to be ranked below average as a used car by Consumer Reports in its annual April car issue and online car rankings.

Here are our used cars to avoid, by category, plus better used car alternatives:

Small Used Car to Avoid: Volkswagen New Beetle

Sure, it's adorable, but the 2007 New Beetle is also trouble-prone. Owners who responded to the Consumer Reports reliability survey reported problems with the fuel and electrical systems, the suspension, brakes, power windows, and other power equipment. The convertible model sells on dealers' lots for $17,055, according to Kelley Blue Book at kbb.com.

Small Used Car Alternative: Ford Focus

It may not be as stylish as the Beetle, but it's a lot more reliable. In fact, the Focus got the J.D. Power award as most reliable compact car. Owners of the 2007 Focus who responded to Consumer Reports reported no major trouble spots. And it's much cheaper than the Beetle. The Kelley Blue Book dealer price is $10,905.

Mid-Size Used Car to Avoid: Chrysler Sebring

The 2007 Sebring sedan not only got just two circles from J.D. Power, Consumer Reports reported a laundry list of problems: engine cooling, minor transmission problems, the drive system, suspension, brakes and more. The low $12,365 dealer price isn't worth it.

Mid-Size Used Car Alternative: Buick LaCrosse

Winner of the J.D. Power dependability award in this category, the 2007 LaCrosse got an above-average used-car rating from Consumer Reports. It's a good value at a dealer price for the CX version at $14,430.

Small Used SUV to Avoid: Jeep Wrangler

King of the off-road, the 2007 Wrangler can climb over almost any obstacle except a reliability test. Owners of the two-door version responding to Consumer Reports reported major transmission problems and issues with the electrical system and brakes. And it's selling on dealer lots at a relatively expensive $19,850.

Small Used SUV Alternative: Honda CR-V

A lot less noticeable than a Wrangler, the Honda CR-V is a lot less trouble, too. It won the J.D. Power dependability award in this category and is rated by Consumer Reports as a well-above-average used car prospect. As a used-car buyer, you are on the wrong side of Honda models' strong ability to hold their value. But at a dealer price of $20,980, the four-wheel-drive version of the CR-V is still a decent value.

Mid-Size SUV to Avoid: GMC Acadia

The 2007 Acadia is a good example of the time-honored rule to avoid buying the first year of a model. It not only got a below-average two circles from J.D. Power, it received a much-worse-than-average used car rating from Consumer Reports. CR readers who owned the 2007 reported problems with the drive system, suspension, body integrity and power equipment. In addition, the all-wheel-drive version on dealers' lots is priced at an expensive $28,435, according to Kelly Blue Book.

Mid-Size SUV Alternative-Honda Pilot

One of a handful of mid-size SUVs to get four circles from J.D. Power, the Pilot is rated well-above-average by Consumer Reports. (Its corporate stablemate, the Accord Crosstour, actually won the J.D. Power award. But many reviewers find its modified-sedan style not big enough to provide true SUV cargo or passenger room.) The Pilot is selling for $23,395-some $5,000 less than the GMC Acadia.

Used Minivan to Avoid: Nissan Quest

Never a strong contender in this category, the Quest gets a below-average used car rating from Consumer Reports and two circles from Power. Owners of the 2007 reported problems with the fuel and climate system, brakes and body integrity. The Quest is selling at $17,395.

Used Minivan Alternative: Toyota Sienna

This van gets four J.D. Power circles and an above-average CR used car rating. Not part of the Toyota sudden-acceleration recall, the Sienna is selling at a dealers' price of $20,280 for the CE trim level.

___

Follow Yahoo! Finance on Twitter; become a fan on Facebook.

Friday, August 27, 2010

Tips for Choosing a Secure Password

Passwords are an essential component to your (online) daily life. We use them to check our online mail, bank accounts, purchase items, etc. But how secure are your passwords? Do you, like many, use the same easy-to-guess password everywhere you go?

Unless you arm yourself with the right passwords, you might as well have none at all. Here are some helpful tips to make sure you stay secure.

Choose Strong PasswordsWant to take a guess at the most popular passwords? According to the Imperva Application Defense Center, it’s the numbers “123456” or the word “password” itself. This means that any cybercriminal who’s looking to hack into your account will likely start there. Why send them an open invitation?Sure, everyone likes passwords that are easy to remember. But you wouldn’t leave your home open and unlocked simply because that’s easier to do than remembering to keep your keys with you. Strong passwords, just like strong locks, deter criminals. Use them.

Tip: Consider mixing a series of letters and numbers, both lower and uppercase. Special characters like asterisks can help as well if they’re permissible. The longer the series, the more secure your password will be. Try for at least eight characters minimum, if possible.

Use Different PasswordsA strong password won’t be very effective if you use the same one everywhere and someone gains access to it. Don’t think it can’t happen. Prying eyes are everywhere. Malware in the form of keystroke loggers can steal your current passwords without you realizing it.

Having a variety of strong passwords is an important key to remaining secure online. Should someone find or guess one of yours, it would be far better if it only unlocks one site rather than everything you have online. Tip: Variety is the spice of life! Choose different passwords for every site you visit.

Never use the same password for your separate bank or credit card accounts.

Never Reveal Your PasswordsYou know that email you just received from your “credit card company”—the one asking you to type in your password to check something? It’s completely bogus. The same applies to any other similar emails. No matter how convincing they may seem, ignore them.These are nothing more than phishing emails, and they’re one reason why you have a delete button. Feel free to use it.

Tip: Stay sharp. Don’t be duped into revealing a password. Any company that would really need this information already has it. And should you find yourself in a situation where you must legitimately reveal a password—such as taking your computer in for repair—make sure you change the password afterwards.Change Your Passwords Regularly After months of trying, you’ve finally memorized that nonsensical series of letters and numbers. Congrats! Now it’s time to change your passwords. Is this to make your life difficult? No. It’s to make stealing your private information more difficult.

Tip: Occasionally swapping out your strong passwords isn’t fun. But it’s much easier than trying to put your life back together after someone has stolen your identity. Make things as hard as you can for cybercriminals. They’ll seek out easier targets—not you.As we’ve discussed, choosing the right passwords can be essential for keeping your private life just that—private. To make the entire process easier, consider using Norton 360. Norton 360 stores your passwords automatically and securely—all while blocking any keystroke loggers or other spyware that could steal your information. You’ll stay safe without the headache of memorizing countless passwords.

Are E-Books Worth the Money?

by Brett Arends

Thursday, August 26, 2010

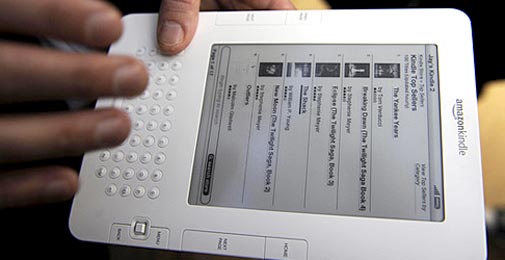

If you walk out of the cinema this week with a burning desire to read Elizabeth Gilbert's "Eat, Pray, Love," you can download it onto your Amazon Kindle electronic book reader — if you have one—for $12.99.

Then again you could just walk into your local Borders bookstore with a coupon and get the paperback for $10.

Barnes & Noble will charge you $12.99 to read the book on its e-book reader, the Nook. But it's only $9.36 (shipping may cost you extra) if you order the paperback at bn.com.

As a society, we have gadget-itis. No new machine that goes ping goes unsung. People stand in line for hours to purchase an iPhone barely distinguishable from the one already in their pockets. Amazon's newest Kindles sold out within days of going on sale. (Those who bought quickly will receive theirs this week.)

E-book readers are booming. Amazon (AMZN - News) says in the past few months sales of e-books have zoomed past sales of the paper ones. While e-books are still in an early stage—the Association of American Publishers says that so far this year they account for 8% of consumer books, compared to just 3% in 2009—the growth rate is dramatic. (This is one of the problems besetting Barnes & Noble, which has just announced a quarterly loss following a decline in sales of traditional books.)

Beyond all the hype, are e-book readers a good deal? Are they worth the money? If so, how can you get the maximum return on your investment?

Here are six money tips for pennywise book lovers.

1. Casual readers probably shouldn't bother.

The median American book-buyer purchases just seven books a year, according to an AP-Ipsos poll in 2007.

An e-book reader right now typically costs about $150 (more on this below). Even if you save a couple of bucks per book by downloading them onto your e-book reader, the payback isn't going to be much for the casual reader. If you saved $5 a book, you'd have to buy 30 just to earn back your initial investment. If you only saved $2 a book, you'd have to buy 75.

I don't want to sound negative. I happen to think e-book readers are great. But that's because I read books avidly. (I've been known to take 10 books on a beach holiday.) If you are in my camp, e-book readers let you carry a library in your pocket or bag. But if you're a casual reader, they probably don't make much economic sense yet. (On the other hand, once you buy an e-book reader you will probably buy and read more books.)

2. The books aren't as cheap as they should be.

E-books are far, far cheaper to produce, distribute and sell than paper ones. There is no paper, no printing, no trucking and no retail space.

So they should cost a lot less to buy, but the deal often isn't anywhere near as good as it should be. Amazon has tried to drive prices for best sellers down to $9.99, but the publishing industry has fought back. A lot of best sellers go for $12.99 instead. That may be cheaper than the hardbacks, but the gap should be wider.

As in the case of Elizabeth Gilbert's runaway success, you may sometimes find the traditional version cheaper. Looking for Stieg Larsson's "The Girl Who Played With Fire"? It's $7.99 on the Kindle. I bought it in Borders, with a coupon, for $5.68.

Books are cheaper in electronic format, but not all.

3. Savvy readers read the classics anyway.

Why? Because they're free. From Aesop to "Zarathustra." From "Hamlet" to "Huckleberry Finn." They won't cost you a penny. These books are outside of copyright. Just go to Gutenberg.org and download them. Thousands of them. And they're better than most of the stuff published more recently anyway.

4. Be aware of the potential costs of buying a Kindle.

Amazon sells the best-selling e-book reader. It's a great product, very easy to use—much easier, I've found, than the competition. But Amazon has given the device a cellular connection and a keyboard so you can access its online bookstore any time, any place, to buy a book. Good for them. Not so good for you. The results are predictable: You may end up making lots of impulse purchases. Don't be surprised if you spend hundreds of dollars on books in your first year. (Amazon now sells a Kindle that only has a Wi-Fi connection instead of cellular. This may save you money, as the connection will only work in a Wi-Fi hot spot. By the time you've found one, you may have decided you don't want the book.)

5. Be aware of the costs of the rivals.

The main ones are time and hassle. The many rivals to the Kindle generally use a software platform from Adobe, and it can be a pain. Even worse: Adobe provides only very basic help if things go wrong. In extremis, you may find yourself emailing India. I asked Adobe why this was. A spokesman explained that because Adobe Digital Editions was given away for free, the company only provides "a baseline level of support, which is web-based," he says. This includes "an active user forum"—in other words asking other customers how to solve your problems. Good luck with that.

If you can overcome that problem, rivals do offer benefits that may save you money. First, they let you shop around for e-books at different online bookstores, and many run promotions. Second, they will let you borrow some e-books online from your local library. Third, many of them come without any wireless connection whatsoever. That means fewer impulse purchases.

6. And if you're thinking of buying a book reader—wait!

At least, hold off for a month or two or maybe even a few weeks. Prices simply have to come down. They may do so fast.

Amazon's first Kindles went on sale three years ago for $399. Its latest versions, out this week, start at just $139. That's cheaper than rivals. They're going to have to respond.

There's an upgrade cycle going on as well. E Ink Corp., the company that makes most of the screens, has developed a newer version with somewhat sharper contrast. (Handy if you're reading fine print, but not so important for most books).

In a rational market, we should see big price cuts this fall, especially as the last of the old models go on sale. Of course, that's in a rational market. Let me know if you ever find one.

Write to Brett Arends at brett.arends@wsj.com

Thursday, August 26, 2010

(Getty Images)

If you walk out of the cinema this week with a burning desire to read Elizabeth Gilbert's "Eat, Pray, Love," you can download it onto your Amazon Kindle electronic book reader — if you have one—for $12.99.

Then again you could just walk into your local Borders bookstore with a coupon and get the paperback for $10.

Barnes & Noble will charge you $12.99 to read the book on its e-book reader, the Nook. But it's only $9.36 (shipping may cost you extra) if you order the paperback at bn.com.

As a society, we have gadget-itis. No new machine that goes ping goes unsung. People stand in line for hours to purchase an iPhone barely distinguishable from the one already in their pockets. Amazon's newest Kindles sold out within days of going on sale. (Those who bought quickly will receive theirs this week.)

E-book readers are booming. Amazon (AMZN - News) says in the past few months sales of e-books have zoomed past sales of the paper ones. While e-books are still in an early stage—the Association of American Publishers says that so far this year they account for 8% of consumer books, compared to just 3% in 2009—the growth rate is dramatic. (This is one of the problems besetting Barnes & Noble, which has just announced a quarterly loss following a decline in sales of traditional books.)

Beyond all the hype, are e-book readers a good deal? Are they worth the money? If so, how can you get the maximum return on your investment?

Here are six money tips for pennywise book lovers.

1. Casual readers probably shouldn't bother.

The median American book-buyer purchases just seven books a year, according to an AP-Ipsos poll in 2007.

An e-book reader right now typically costs about $150 (more on this below). Even if you save a couple of bucks per book by downloading them onto your e-book reader, the payback isn't going to be much for the casual reader. If you saved $5 a book, you'd have to buy 30 just to earn back your initial investment. If you only saved $2 a book, you'd have to buy 75.

I don't want to sound negative. I happen to think e-book readers are great. But that's because I read books avidly. (I've been known to take 10 books on a beach holiday.) If you are in my camp, e-book readers let you carry a library in your pocket or bag. But if you're a casual reader, they probably don't make much economic sense yet. (On the other hand, once you buy an e-book reader you will probably buy and read more books.)

2. The books aren't as cheap as they should be.

E-books are far, far cheaper to produce, distribute and sell than paper ones. There is no paper, no printing, no trucking and no retail space.

So they should cost a lot less to buy, but the deal often isn't anywhere near as good as it should be. Amazon has tried to drive prices for best sellers down to $9.99, but the publishing industry has fought back. A lot of best sellers go for $12.99 instead. That may be cheaper than the hardbacks, but the gap should be wider.

As in the case of Elizabeth Gilbert's runaway success, you may sometimes find the traditional version cheaper. Looking for Stieg Larsson's "The Girl Who Played With Fire"? It's $7.99 on the Kindle. I bought it in Borders, with a coupon, for $5.68.

Books are cheaper in electronic format, but not all.

3. Savvy readers read the classics anyway.

Why? Because they're free. From Aesop to "Zarathustra." From "Hamlet" to "Huckleberry Finn." They won't cost you a penny. These books are outside of copyright. Just go to Gutenberg.org and download them. Thousands of them. And they're better than most of the stuff published more recently anyway.

4. Be aware of the potential costs of buying a Kindle.

Amazon sells the best-selling e-book reader. It's a great product, very easy to use—much easier, I've found, than the competition. But Amazon has given the device a cellular connection and a keyboard so you can access its online bookstore any time, any place, to buy a book. Good for them. Not so good for you. The results are predictable: You may end up making lots of impulse purchases. Don't be surprised if you spend hundreds of dollars on books in your first year. (Amazon now sells a Kindle that only has a Wi-Fi connection instead of cellular. This may save you money, as the connection will only work in a Wi-Fi hot spot. By the time you've found one, you may have decided you don't want the book.)

5. Be aware of the costs of the rivals.

The main ones are time and hassle. The many rivals to the Kindle generally use a software platform from Adobe, and it can be a pain. Even worse: Adobe provides only very basic help if things go wrong. In extremis, you may find yourself emailing India. I asked Adobe why this was. A spokesman explained that because Adobe Digital Editions was given away for free, the company only provides "a baseline level of support, which is web-based," he says. This includes "an active user forum"—in other words asking other customers how to solve your problems. Good luck with that.

If you can overcome that problem, rivals do offer benefits that may save you money. First, they let you shop around for e-books at different online bookstores, and many run promotions. Second, they will let you borrow some e-books online from your local library. Third, many of them come without any wireless connection whatsoever. That means fewer impulse purchases.

6. And if you're thinking of buying a book reader—wait!

At least, hold off for a month or two or maybe even a few weeks. Prices simply have to come down. They may do so fast.

Amazon's first Kindles went on sale three years ago for $399. Its latest versions, out this week, start at just $139. That's cheaper than rivals. They're going to have to respond.

There's an upgrade cycle going on as well. E Ink Corp., the company that makes most of the screens, has developed a newer version with somewhat sharper contrast. (Handy if you're reading fine print, but not so important for most books).

In a rational market, we should see big price cuts this fall, especially as the last of the old models go on sale. Of course, that's in a rational market. Let me know if you ever find one.

Write to Brett Arends at brett.arends@wsj.com

Wednesday, August 25, 2010

7 Best Stress-Fighting Foods

By David Zinczenko

I send out a lot of info on my Twitter feed, from nutrition news to management tips. I get the most passionate reaction—and the most retweets—when I talk about stress. In fact, a friend of mine recently told me that stress was her biggest dietary villain. “I eat when I’m stressed,” she said.

To which I reacted, “Good!” You should eat when you’re stressed—it’s our bodies’ natural reaction to want to store calories to face whatever challenge is causing the stress in the first place. The key, however, is to eat what your body wants—the foods that actually counteract the effects of stress, and make you stronger (and leaner) when the tough times pass. So next time anxiety runs high, be sure to grab one of these seven stress-fighting foods.

(And while you're at it, be sure to follow my Twitter feed for hundreds of instant nutrition and health secrets like these.)

Papaya

Wouldn’t it be awesome if there was a magic nutrient that could stop the flow of stress hormones—the very hormones that make your body superefficient at storing fat calories? Wouldn’t you want to gobble that food up like crazy, especially if it tasted great? Half a medium papaya carries nearly 75 percent more vitamin C than an orange, and provides potent protection against stress. Researchers at the University of Alabama found 200 milligrams of vitamin C—about as much as you’ll find in one large papaya—twice a day nearly stopped the flow of stress hormones in rats. It should work for you, too.

Other smart sources of vitamin C: Red bell peppers, broccoli, oranges

Bonus Tip: The closer an ingredient is to its original form, the healthier it is for you. Avoid the worst side of the nutritional spectrum by familiarizing yourself with this shocking list of The 15 Worst Food Creations of 2010.

Peppermint Tea

The mere scent of peppermint helps you focus and boosts performance, according to researchers. Another study discovered that peppermint tea makes drivers more alert and less anxious.

Other smart sources of peppermint: Peppermint candy and peppermint oil

Bonus Tip: Beware of disastrous drinks that only pretend to be healthy. Avoid 2,000-calorie shakes, 1,500-calorie smoothies, and other big offenders in this eye-popping list of The 20 Worst Drinks in America in 2010.

Pumpkin Seeds

Pumpkin seeds are loaded with stress-busting potential thanks to high levels of magnesium. Only about 30 percent of us meet our daily magnesium requirements, placing the rest of us at a higher risk for stress symptoms such as headaches, anxiety, tension, fatigue, insomnia, nervousness and high blood pressure. (Basically we’re frayed wires, and magnesium is the electrical tape that can pull us back together.) A quarter cup of pumpkin seeds gives you half your day’s magnesium requirements.

Other smart sources of magnesium: Spinach, Swiss chard, black beans, soybeans, salmon

Avocados

The healthy fats buried in the avocado’s flesh make it an ideal choice when you’re craving something rich and creamy. The reasons? Monounsaturated (healthy) fatty acids, and potassium--both of which help combat high blood pressure. Avocado fat is 66 percent monounsaturated, and gram-for-gram, the green fruit has about 35 percent more potassium than a banana. Whip up a fresh guacamole or slice a few slivers over toast and top with fresh ground pepper.

Other smart sources of potassium: Squash, papaya, spinach, bananas, lentils

Bonus Tip: Learn how to put these and other health-promoting foods to work in your daily diet to lose weight fast and look and feel better. Sign up for the free Cook This, Not That! newsletter. You’ll have quick and delicious recipes delivered right to you inbox.

Salmon

Not only does omega-3 fat protect against heart disease and cognitive decline, but according to a study from Diabetes & Metabolism, the wonder fat is also responsible for maintaining healthy levels of cortisol. And what’s the world’s best source of omega-3s? Salmon. But there’s another trick in salmon’s arsenal—a sleep-promoting amino acid called tryptophan. One salmon filet has as much tryptophan as you need in an entire day, and if there’s one remedy for stress, it’s a good night of blissful Zs.

Other smart sources of omega-3 fats: Flaxseeds, walnuts, sardines, halibut

Other smart sources of tryptophan: Chicken, tuna, beef, soybeans

Bonus Tip: The favorite trick of your friendly neighborhood restaurant? Substituting salt for flavor. Studies have linked high-salt foods to increased risk of high blood pressure, stroke, and even heart disease--and experts recommend getting no more than 2,300 milligrams of sodium in your diet each day. Keep your salt intake in check by cooking with high-quality, locally sourced ingredients—and by dodging the salty disasters in this list of the 30 Saltiest Foods in America.

Almonds

The almond's first stress-buster is the aforementioned monounsaturated fats, but at risk of belaboring that point, let’s look at another almond-centered, mind-calming nutrient: vitamin E. In one study, Belgium researchers treated pigs with a variety of nutrients just before sticking them in a transportation simulator (basically a vibrating crate). After 2 hours of simulation, only those pigs treated with tryptophan and vitamin E had non-elevated levels of stress hormones. Almonds, thankfully, are loaded with vitamin E. To reach your day’s requirement from almonds alone, you need to eat about 40 to 50 nuts. Or you can mix them with other vitamin-E rich foods to save calories and add more dietary variety.

Other smart sources of vitamin E: Sunflower seeds, olives, spinach, papaya

Oatmeal

A biochemical effect of stress is a depleted stock of serotonin, the hormone that makes you feel cool, calm, and in control. One reliable strategy for boosting serotonin back to healthy levels is to increase your intake of carbohydrates. That said, scarfing down Ding Dongs and doughnuts isn’t a sustainable solution. Rather, to induce a steady flow of serotonin, aim to eat fiber-rich, whole-grain carbohydrates. The slower rate of digestion will keep seratonin production steady and prevent the blood sugar rollar-coaster that leads to mood swings and mindless eating.

Other sources of fiber-rich carbohydrates: Quinoa, barley, whole-wheat bread, Triscuits

I send out a lot of info on my Twitter feed, from nutrition news to management tips. I get the most passionate reaction—and the most retweets—when I talk about stress. In fact, a friend of mine recently told me that stress was her biggest dietary villain. “I eat when I’m stressed,” she said.

To which I reacted, “Good!” You should eat when you’re stressed—it’s our bodies’ natural reaction to want to store calories to face whatever challenge is causing the stress in the first place. The key, however, is to eat what your body wants—the foods that actually counteract the effects of stress, and make you stronger (and leaner) when the tough times pass. So next time anxiety runs high, be sure to grab one of these seven stress-fighting foods.

(And while you're at it, be sure to follow my Twitter feed for hundreds of instant nutrition and health secrets like these.)

Papaya

Wouldn’t it be awesome if there was a magic nutrient that could stop the flow of stress hormones—the very hormones that make your body superefficient at storing fat calories? Wouldn’t you want to gobble that food up like crazy, especially if it tasted great? Half a medium papaya carries nearly 75 percent more vitamin C than an orange, and provides potent protection against stress. Researchers at the University of Alabama found 200 milligrams of vitamin C—about as much as you’ll find in one large papaya—twice a day nearly stopped the flow of stress hormones in rats. It should work for you, too.

Other smart sources of vitamin C: Red bell peppers, broccoli, oranges

Bonus Tip: The closer an ingredient is to its original form, the healthier it is for you. Avoid the worst side of the nutritional spectrum by familiarizing yourself with this shocking list of The 15 Worst Food Creations of 2010.

Peppermint Tea

The mere scent of peppermint helps you focus and boosts performance, according to researchers. Another study discovered that peppermint tea makes drivers more alert and less anxious.

Other smart sources of peppermint: Peppermint candy and peppermint oil

Bonus Tip: Beware of disastrous drinks that only pretend to be healthy. Avoid 2,000-calorie shakes, 1,500-calorie smoothies, and other big offenders in this eye-popping list of The 20 Worst Drinks in America in 2010.

Pumpkin Seeds

Pumpkin seeds are loaded with stress-busting potential thanks to high levels of magnesium. Only about 30 percent of us meet our daily magnesium requirements, placing the rest of us at a higher risk for stress symptoms such as headaches, anxiety, tension, fatigue, insomnia, nervousness and high blood pressure. (Basically we’re frayed wires, and magnesium is the electrical tape that can pull us back together.) A quarter cup of pumpkin seeds gives you half your day’s magnesium requirements.

Other smart sources of magnesium: Spinach, Swiss chard, black beans, soybeans, salmon

Avocados

The healthy fats buried in the avocado’s flesh make it an ideal choice when you’re craving something rich and creamy. The reasons? Monounsaturated (healthy) fatty acids, and potassium--both of which help combat high blood pressure. Avocado fat is 66 percent monounsaturated, and gram-for-gram, the green fruit has about 35 percent more potassium than a banana. Whip up a fresh guacamole or slice a few slivers over toast and top with fresh ground pepper.

Other smart sources of potassium: Squash, papaya, spinach, bananas, lentils

Bonus Tip: Learn how to put these and other health-promoting foods to work in your daily diet to lose weight fast and look and feel better. Sign up for the free Cook This, Not That! newsletter. You’ll have quick and delicious recipes delivered right to you inbox.

Salmon

Not only does omega-3 fat protect against heart disease and cognitive decline, but according to a study from Diabetes & Metabolism, the wonder fat is also responsible for maintaining healthy levels of cortisol. And what’s the world’s best source of omega-3s? Salmon. But there’s another trick in salmon’s arsenal—a sleep-promoting amino acid called tryptophan. One salmon filet has as much tryptophan as you need in an entire day, and if there’s one remedy for stress, it’s a good night of blissful Zs.

Other smart sources of omega-3 fats: Flaxseeds, walnuts, sardines, halibut

Other smart sources of tryptophan: Chicken, tuna, beef, soybeans

Bonus Tip: The favorite trick of your friendly neighborhood restaurant? Substituting salt for flavor. Studies have linked high-salt foods to increased risk of high blood pressure, stroke, and even heart disease--and experts recommend getting no more than 2,300 milligrams of sodium in your diet each day. Keep your salt intake in check by cooking with high-quality, locally sourced ingredients—and by dodging the salty disasters in this list of the 30 Saltiest Foods in America.

Almonds

The almond's first stress-buster is the aforementioned monounsaturated fats, but at risk of belaboring that point, let’s look at another almond-centered, mind-calming nutrient: vitamin E. In one study, Belgium researchers treated pigs with a variety of nutrients just before sticking them in a transportation simulator (basically a vibrating crate). After 2 hours of simulation, only those pigs treated with tryptophan and vitamin E had non-elevated levels of stress hormones. Almonds, thankfully, are loaded with vitamin E. To reach your day’s requirement from almonds alone, you need to eat about 40 to 50 nuts. Or you can mix them with other vitamin-E rich foods to save calories and add more dietary variety.

Other smart sources of vitamin E: Sunflower seeds, olives, spinach, papaya

Oatmeal

A biochemical effect of stress is a depleted stock of serotonin, the hormone that makes you feel cool, calm, and in control. One reliable strategy for boosting serotonin back to healthy levels is to increase your intake of carbohydrates. That said, scarfing down Ding Dongs and doughnuts isn’t a sustainable solution. Rather, to induce a steady flow of serotonin, aim to eat fiber-rich, whole-grain carbohydrates. The slower rate of digestion will keep seratonin production steady and prevent the blood sugar rollar-coaster that leads to mood swings and mindless eating.

Other sources of fiber-rich carbohydrates: Quinoa, barley, whole-wheat bread, Triscuits

Monday, August 23, 2010

8 Things You Didn't Know About Toothpaste

By Jordan Shakeshaft, Woman's Day

Fri, Aug 20, 2010

Faced with dozens of different products promising to make your teeth fresher, whiter and cavity-free, it’s no wonder you wander aimlessly down the toothpaste aisle. To help you pick wisely, we turned to the pros for the scoop on what ingredients to look for, whether gel or paste formulas are right for you and just how much you need to squeeze onto your brush. It’s never too late to get your pearly whites in tip-top shape, so read on to find out how!

1. It’s all about the fluoride.

With a host of ingredients in toothpaste, it’s easy to lose sight of what’s essential. But no matter what your individual needs are (i.e., tartar control, whitening, breath-freshening and so on), dental hygienists agree that fluoride is a must. According to the Academy of General Dentistry, brushing with fluoride toothpaste twice daily can reduce tooth decay by as much as 40 percent. “Even in areas where there is water fluoridation, the added fluoride in toothpaste has been shown to be very beneficial,” says Caryn Loftis-Solie, RDH, president of the American Dental Hygiene Association (ADHA).

2. Look for the seal of approval.

While it’s tempting to save some cash with a generic brand of toothpaste, you may actually be getting an ineffective—and potentially harmful—product. “You should always look for the ADA Seal when choosing a toothpaste,” says Clifford Whall, PhD, director of the American Dental Association (ADA) Seal of Acceptance Program. “Only those products have the scientific data to back up their claims and have been proven to meet our criteria for safety and effectiveness.” With 50-plus approved toothpastes on shelves, it’s easy to find a tube that’s right for you and your budget.

3. Whitening toothpastes work—at least to a certain degree.

Countless products promise a whiter smile, but do they really deliver? “Whitening toothpastes—like all toothpastes—contain mild abrasives to help remove surface stains on your teeth,” says Dr. Whall. “The shape of the particles used in whitening products, though, is modified to clean those stains away better, so you’ll see a noticeable difference in how your teeth look.” However, according to Dr. Whall, these products don’t contain bleach, making it impossible for them to brighten your smile as dramatically as professional whitening treatments.

4. Less is more.

Despite what you see on commercials, a brush full of toothpaste won’t clean your pearly whites any better than half that amount, according to E. Jane Crocker, RHD, president of the Massachusetts Dental Hygienists’ Association. “All you need is a pea-size amount of toothpaste—yes, I mean the little green vegetable!” Not only will that get the job done effectively (by cleaning and removing plaque, stains and food debris), you’ll also extend the life of your tube.

5. How you brush is more important than what you brush with.

You can buy the best toothpaste and toothbrush on the market, but if you aren’t brushing correctly you won’t see results. “To do it properly, you need to position the brush at a 45 degree angle so that you get some of the bristles in between the tooth and the gums,” says Dr. Whall. “Move the brush in small circles in those areas, and then continue on to the rest of the teeth. This process should take about one to two minutes to complete.” View the ADA’s step-by-step guide to brushing and flossing here.

6. Organic toothpastes can be just as effective as regular.

If you’re willing to spend a little more to go green, natural and organic toothpastes can be a good eco-friendly alternative to commercial brands—provided they contain fluoride. “Natural and organic toothpastes that include fluoride in their ingredients are as effective as regular toothpastes with fluoride,” says Crocker. You’ll also be avoiding artificial preservatives, sweeteners and dyes.

7. What’s inside your toothpaste might surprise you.

You may not recognize the names listed on the side of the tube, but ingredients like seaweed and detergent can be found in many fluoride toothpastes. According to the ADA, common thickening agents include seaweed colloids, mineral colloids and natural gums. And for that quintessential foaming action, most products rely on detergents such as sodium lauryl sulfate—also found in many shampoos and body washes—that are deemed 100 percent safe and effective by the ADA.

8. Pastes or gels—they all do the trick.

You may have heard that one works better than the other but, according to the experts, they all clean teeth equally well. “Other than flavor, texture and how it makes a person feel, there aren’t any major differences among the various forms,” says Crocker. “I think it comes down to personal preference, which might come through trial and error. I encourage my patients to use whichever product encourages them to brush.”

Fri, Aug 20, 2010

Faced with dozens of different products promising to make your teeth fresher, whiter and cavity-free, it’s no wonder you wander aimlessly down the toothpaste aisle. To help you pick wisely, we turned to the pros for the scoop on what ingredients to look for, whether gel or paste formulas are right for you and just how much you need to squeeze onto your brush. It’s never too late to get your pearly whites in tip-top shape, so read on to find out how!

1. It’s all about the fluoride.

With a host of ingredients in toothpaste, it’s easy to lose sight of what’s essential. But no matter what your individual needs are (i.e., tartar control, whitening, breath-freshening and so on), dental hygienists agree that fluoride is a must. According to the Academy of General Dentistry, brushing with fluoride toothpaste twice daily can reduce tooth decay by as much as 40 percent. “Even in areas where there is water fluoridation, the added fluoride in toothpaste has been shown to be very beneficial,” says Caryn Loftis-Solie, RDH, president of the American Dental Hygiene Association (ADHA).

2. Look for the seal of approval.

While it’s tempting to save some cash with a generic brand of toothpaste, you may actually be getting an ineffective—and potentially harmful—product. “You should always look for the ADA Seal when choosing a toothpaste,” says Clifford Whall, PhD, director of the American Dental Association (ADA) Seal of Acceptance Program. “Only those products have the scientific data to back up their claims and have been proven to meet our criteria for safety and effectiveness.” With 50-plus approved toothpastes on shelves, it’s easy to find a tube that’s right for you and your budget.

3. Whitening toothpastes work—at least to a certain degree.

Countless products promise a whiter smile, but do they really deliver? “Whitening toothpastes—like all toothpastes—contain mild abrasives to help remove surface stains on your teeth,” says Dr. Whall. “The shape of the particles used in whitening products, though, is modified to clean those stains away better, so you’ll see a noticeable difference in how your teeth look.” However, according to Dr. Whall, these products don’t contain bleach, making it impossible for them to brighten your smile as dramatically as professional whitening treatments.

4. Less is more.

Despite what you see on commercials, a brush full of toothpaste won’t clean your pearly whites any better than half that amount, according to E. Jane Crocker, RHD, president of the Massachusetts Dental Hygienists’ Association. “All you need is a pea-size amount of toothpaste—yes, I mean the little green vegetable!” Not only will that get the job done effectively (by cleaning and removing plaque, stains and food debris), you’ll also extend the life of your tube.

5. How you brush is more important than what you brush with.

You can buy the best toothpaste and toothbrush on the market, but if you aren’t brushing correctly you won’t see results. “To do it properly, you need to position the brush at a 45 degree angle so that you get some of the bristles in between the tooth and the gums,” says Dr. Whall. “Move the brush in small circles in those areas, and then continue on to the rest of the teeth. This process should take about one to two minutes to complete.” View the ADA’s step-by-step guide to brushing and flossing here.

6. Organic toothpastes can be just as effective as regular.

If you’re willing to spend a little more to go green, natural and organic toothpastes can be a good eco-friendly alternative to commercial brands—provided they contain fluoride. “Natural and organic toothpastes that include fluoride in their ingredients are as effective as regular toothpastes with fluoride,” says Crocker. You’ll also be avoiding artificial preservatives, sweeteners and dyes.

7. What’s inside your toothpaste might surprise you.

You may not recognize the names listed on the side of the tube, but ingredients like seaweed and detergent can be found in many fluoride toothpastes. According to the ADA, common thickening agents include seaweed colloids, mineral colloids and natural gums. And for that quintessential foaming action, most products rely on detergents such as sodium lauryl sulfate—also found in many shampoos and body washes—that are deemed 100 percent safe and effective by the ADA.

8. Pastes or gels—they all do the trick.

You may have heard that one works better than the other but, according to the experts, they all clean teeth equally well. “Other than flavor, texture and how it makes a person feel, there aren’t any major differences among the various forms,” says Crocker. “I think it comes down to personal preference, which might come through trial and error. I encourage my patients to use whichever product encourages them to brush.”

Motorist's Dream: Gas at 6 Cents a Gallon

by Stacy Johnson

Friday, August 20, 2010

Provided by MoneyTalksNews

___________________________________________________________________________

Gassing up isn't cheap: According to AAA, we're now paying a nationwide average of $2.73 for a gallon of regular. That's about 25 cents a gallon more than last year. But it's certainly better than the year before, when prices shot up to over $4/gallon.

But if the cost of gas bothers you, be happy you don't live in Asmara, Eritrea. This African nation boasts the highest gas prices in the world — nearly $10/gallon. On the other hand, you could be living in Venezuela, where prices are as low as 6 cents.

Here's a list of the places with the highest and lowest gas prices in the world, courtesy of the Oil Price Information Service (OPIS).

The World's Highest Gas Prices:

1. Asmara, Eritrea — $9.59/gallon

2. Oslo, Norway — $7.41/gallon

3. Copenhagen, Denmark — $6.89/gallon

4. Hong Kong — $6.87/gallon

5. Monaco, Monte Carlo — $6.82/gallon

The World's Lowest Gas Prices:

1. Caracas, Venezuela — 6 cents/gallon

2. Tehran, Iran — 32 cents/gallon

3. Riyadh, Saudi Arabia — 45 cents/gallon

4. Kuwait, City, Kuwait — 85 cents/gallon

5. Cairo, Egypt — $1.17/gallon

So here we have a homogeneous product — pretty much the same in Caracas as it is in Asmara — ranging in price from 6 cents to nearly $10 a gallon. Why the big range? Looking at the list will offer the first hint: Most of the countries on the low-price list have lots of oil.

But another reason gas prices vary so widely is what the government does with gasoline. They control the price and/or consumption by loading on taxes, or in the case of Venezuela, subsidizing the price.

While the wild world of fossil fuel pricing is interesting, what gas costs in Asmara, Tehran and Oslo is ultimately only of interest to those who gas up there. What we're interested in is paying less for gas in our own neighborhoods. How do we find the cheapest gas?

Use Your Smart Phone

If you have a smart phone, go to where you can download apps (such as the Apple App Store or the Android Market) and do a search for "gas prices." You'll discover several free apps that will help you find prices at nearby stations. Note, however, that most of these apps are self-reporting — they depend on other app users to send in prices. That leads to two potential problems: First, gas prices may be out of date or inaccurate. Second, there's nothing that prevents the station owner from gaming the system by putting in a false low price to attract customers.

There are apps that don't depend on user-supported prices. AAA's TripTik iPhone App, for example, uses prices reported by the Oil Price Information Service and are derived from credit card transactions at more than 100,000 stations around the country, updated daily. The problem with this reporting method? Price can change more often than daily, and while 100,000 is a lot of stations to survey, it's not all of them.

Use your computer

There are several websites that will help you find the cheapest gas in your area. A few examples, all of which allow you to search by zip code:

• Gasbuddy

• MSN gas prices

• Gas Price Watch

• Mapquest Gas Prices

• FuelMeUp

Like the smart-phone apps, most of these sites feature user-reported prices or Oil Price Information Service-reported prices, so the same caveats apply.

In doing research for this story, I talked to Fred Rozell, director of retail pricing for the Oil Price Information Service. He says that if the economy remains sluggish and provided there are no supply disruptions, we could see pump prices drop by as much as 50 cents a gallon after hurricane season.

Friday, August 20, 2010

Provided by MoneyTalksNews

___________________________________________________________________________

Gassing up isn't cheap: According to AAA, we're now paying a nationwide average of $2.73 for a gallon of regular. That's about 25 cents a gallon more than last year. But it's certainly better than the year before, when prices shot up to over $4/gallon.

But if the cost of gas bothers you, be happy you don't live in Asmara, Eritrea. This African nation boasts the highest gas prices in the world — nearly $10/gallon. On the other hand, you could be living in Venezuela, where prices are as low as 6 cents.

Here's a list of the places with the highest and lowest gas prices in the world, courtesy of the Oil Price Information Service (OPIS).

The World's Highest Gas Prices:

1. Asmara, Eritrea — $9.59/gallon

2. Oslo, Norway — $7.41/gallon

3. Copenhagen, Denmark — $6.89/gallon

4. Hong Kong — $6.87/gallon

5. Monaco, Monte Carlo — $6.82/gallon

The World's Lowest Gas Prices:

1. Caracas, Venezuela — 6 cents/gallon

2. Tehran, Iran — 32 cents/gallon

3. Riyadh, Saudi Arabia — 45 cents/gallon

4. Kuwait, City, Kuwait — 85 cents/gallon

5. Cairo, Egypt — $1.17/gallon

So here we have a homogeneous product — pretty much the same in Caracas as it is in Asmara — ranging in price from 6 cents to nearly $10 a gallon. Why the big range? Looking at the list will offer the first hint: Most of the countries on the low-price list have lots of oil.

But another reason gas prices vary so widely is what the government does with gasoline. They control the price and/or consumption by loading on taxes, or in the case of Venezuela, subsidizing the price.

While the wild world of fossil fuel pricing is interesting, what gas costs in Asmara, Tehran and Oslo is ultimately only of interest to those who gas up there. What we're interested in is paying less for gas in our own neighborhoods. How do we find the cheapest gas?

Use Your Smart Phone

If you have a smart phone, go to where you can download apps (such as the Apple App Store or the Android Market) and do a search for "gas prices." You'll discover several free apps that will help you find prices at nearby stations. Note, however, that most of these apps are self-reporting — they depend on other app users to send in prices. That leads to two potential problems: First, gas prices may be out of date or inaccurate. Second, there's nothing that prevents the station owner from gaming the system by putting in a false low price to attract customers.

There are apps that don't depend on user-supported prices. AAA's TripTik iPhone App, for example, uses prices reported by the Oil Price Information Service and are derived from credit card transactions at more than 100,000 stations around the country, updated daily. The problem with this reporting method? Price can change more often than daily, and while 100,000 is a lot of stations to survey, it's not all of them.

Use your computer

There are several websites that will help you find the cheapest gas in your area. A few examples, all of which allow you to search by zip code:

• Gasbuddy

• MSN gas prices

• Gas Price Watch

• Mapquest Gas Prices

• FuelMeUp

Like the smart-phone apps, most of these sites feature user-reported prices or Oil Price Information Service-reported prices, so the same caveats apply.

In doing research for this story, I talked to Fred Rozell, director of retail pricing for the Oil Price Information Service. He says that if the economy remains sluggish and provided there are no supply disruptions, we could see pump prices drop by as much as 50 cents a gallon after hurricane season.

Sunday, August 22, 2010

25 Hot Careers That Didn't Exist 10 Years Ago

By JoVon Sotak,

What did you want to be when you grew up? Astronaut? Movie star? Superhero? Whatever made your list, green marketer probably wasn't on it--but that job may be on the lists of today's youngsters.

Here's a list of emerging careers that you (and your inner child) can get excited about. You couldn't have daydreamed about any of these jobs when you were a child--because they didn't exist then. In fact, they're so new that, although they're starting to be recognized, the U.S. Bureau of Labor Statistics doesn't yet have data on them. If you've been looking for a new dream job or haven't decided what you want to be when you "grow up," these are 25 new options.

Business

A specialized business degree can help you obtain the skills you need to work in one of these professions.

1. Business continuity specialists plan and implement recovery solutions to keep businesses functioning during disasters and emergency situations.

2. Electronic commerce specialists analyze online buyers' preferences and handle online sales strategies, including marketing, advertising, and website design.

3. Social media managers/strategists use social technologies like Facebook to reach out to customers, and they build social networks within companies.

4. Virtual concierges provide professional concierge services--for business or personal needs--with the convenience of being just an email away.

5. User experience analysts collect data on website usage and provide insight about users' experiences by using psychological, computer-science, and industrial-design knowledge to test theories and draw conclusions.

Source: Yahoo news

What did you want to be when you grew up? Astronaut? Movie star? Superhero? Whatever made your list, green marketer probably wasn't on it--but that job may be on the lists of today's youngsters.

Here's a list of emerging careers that you (and your inner child) can get excited about. You couldn't have daydreamed about any of these jobs when you were a child--because they didn't exist then. In fact, they're so new that, although they're starting to be recognized, the U.S. Bureau of Labor Statistics doesn't yet have data on them. If you've been looking for a new dream job or haven't decided what you want to be when you "grow up," these are 25 new options.

Business

A specialized business degree can help you obtain the skills you need to work in one of these professions.

1. Business continuity specialists plan and implement recovery solutions to keep businesses functioning during disasters and emergency situations.

2. Electronic commerce specialists analyze online buyers' preferences and handle online sales strategies, including marketing, advertising, and website design.

3. Social media managers/strategists use social technologies like Facebook to reach out to customers, and they build social networks within companies.

4. Virtual concierges provide professional concierge services--for business or personal needs--with the convenience of being just an email away.

5. User experience analysts collect data on website usage and provide insight about users' experiences by using psychological, computer-science, and industrial-design knowledge to test theories and draw conclusions.

Source: Yahoo news

Friday, August 20, 2010

Massive egg recall: How to check your carton for recalled eggs

A massive egg recall by Write County Egg has sickened hundreds of people, and affected 13 retail brands that the egg factory packages. The culprit: Salmonella on egg shells.

(Photo: FDA)

The egg brands affected by the recall include: Lucerne, Albertson, Mountain Dairy, Ralph’s, Boomsma’s, Sunshine, Hillandale, Trafficanda, Farm Fresh, Shoreland, Lund, Dutch Farms, and Kemps.

Eggs are packed in 6- 12- or 18-egg cartons with Julian dates ranging from 136 to 225 and plant numbers 1026, 1413, and 1946

Dates and codes can be found stamped on the end of the egg carton. The plant number begins with the letter P and then the number. The Julian date follows the plant number, for example: P-1946 223.

Consumers should not eat the eggs and should return recalled eggs to the store where they were purchased for a full refund.

Bacterial contamination on modern industrial-scale chicken farms (factories, really) is a growing problem. Cramped conditions are breeding grounds for disease. Widespread use of antibiotics is creating drug-resistant strains of bacteria.

One antidote to the problem is to choose locally sourced eggs from farms that allow their chickens to run free. Though be aware that the label "free range" doesn't mean what you might think.

Salmonella poisoning symptoms

Within 6-to-72 hours of eating an egg, you may experience lower abdominal cramps, diarrhea (sometimes bloody), vomiting, fever, chills, malaise, nausea or headache. Symptoms may persist for as long as a week. While most people recover without treatment, some patients require hospitalization.

Among the 21,244 cases of foodborne illness reported from tainted food-related outbreaks in the United States in 2007 (the last year for which data is available from the Centers for Disease Control and Prevention), salmonella was the No. 2 cause of illness, causing 27% of foodborne illness outbreaks, including 55% of multi-state outbreaks, and 81 illnesses attributed to salmonella in eggs; five deaths resulted from salmonella-contaminated food. The two biggest foodborne illness outbreaks that year were caused by salmonella, in hummus and frozen pot pies.

(Photo: FDA)

The egg brands affected by the recall include: Lucerne, Albertson, Mountain Dairy, Ralph’s, Boomsma’s, Sunshine, Hillandale, Trafficanda, Farm Fresh, Shoreland, Lund, Dutch Farms, and Kemps.

Eggs are packed in 6- 12- or 18-egg cartons with Julian dates ranging from 136 to 225 and plant numbers 1026, 1413, and 1946

Dates and codes can be found stamped on the end of the egg carton. The plant number begins with the letter P and then the number. The Julian date follows the plant number, for example: P-1946 223.

Consumers should not eat the eggs and should return recalled eggs to the store where they were purchased for a full refund.

Bacterial contamination on modern industrial-scale chicken farms (factories, really) is a growing problem. Cramped conditions are breeding grounds for disease. Widespread use of antibiotics is creating drug-resistant strains of bacteria.

One antidote to the problem is to choose locally sourced eggs from farms that allow their chickens to run free. Though be aware that the label "free range" doesn't mean what you might think.

Salmonella poisoning symptoms

Within 6-to-72 hours of eating an egg, you may experience lower abdominal cramps, diarrhea (sometimes bloody), vomiting, fever, chills, malaise, nausea or headache. Symptoms may persist for as long as a week. While most people recover without treatment, some patients require hospitalization.

Among the 21,244 cases of foodborne illness reported from tainted food-related outbreaks in the United States in 2007 (the last year for which data is available from the Centers for Disease Control and Prevention), salmonella was the No. 2 cause of illness, causing 27% of foodborne illness outbreaks, including 55% of multi-state outbreaks, and 81 illnesses attributed to salmonella in eggs; five deaths resulted from salmonella-contaminated food. The two biggest foodborne illness outbreaks that year were caused by salmonella, in hummus and frozen pot pies.

Thursday, August 19, 2010

15 Things You Shouldn't Be Paying For

By Phil Taylor

Thursday, August 19, 2010

So much money and energy is wasted on things we could get for free. If you're into new, shiny things and collecting stuff, this is not for you. But if you want less clutter in your life and want to keep more of your money, then check out these 15 things you shouldn't be paying for.

Basic Computer Software -- Thinking of purchasing a new computer? Think twice before you fork over the funds for a bunch of extra software. There are some great alternatives to the name brand software programs. The most notable is OpenOffice, the open-source alternative to those other guys. It's completely free and files can be exported in compatible formats.

Your Credit Report -- You don't have to pay for your credit report. You could sign up for one of the free credit monitoring services online to get a quick look at your credit report. You just have to remember to cancel the service before the end of the free trial. Or you could do one better and visit www.annualcreditreport.com, the only truly free place to see all three of your credit reports for free once a year.

Cell Phone -- The service plan may be expensive, but the phone itself doesn't have to cost a thing. Most major carriers will give you a free phone, even a free smart phone, with a two-year contract.

Books -- There's a cool place in your town that's renting out books for free: the library. Remember that place? Stop by and put your favorite book on reserve. And if you don't feel like getting out, visit www.paperbackswap.com and find your books there (small shipping fees apply).

Water -- Besides the monthly utility bill, there's no reason to shell out $1 for every bottle of water you drink. Bottled water is so last decade anyway. We're over it, and into tap, filters, and reusable water bottles. It's cheaper for you and better for the environment.

Credit Card -- With as many credit cards as there are available on the market today, it's easy to avoid a credit card with an annual fee. Unless you're dead set on a particular perk that a fee card brings, skip the annual fee card and pocket that money yourself.

Debt Reduction Help -- Speaking of credit cards, if you're in over your head with credit card help, there are many free sources you can turn to for help with your debt. No one is going to be able to magically wipe away your debts, but there is help out there that will set you up on a debt reduction plan you can handle. Start with a visit to the National Foundation for Credit Counseling.

Basic Tax Preparation -- If your tax situation isn't that complicated, then you should probably be preparing your own tax return using one of the many free online services. It's now common for e-filing to be free as well with many services. You won't even need a stamp.

The News -- Leave it to a blogger to try and kill off traditional print. I'm not anti-newspaper. I just don't find them practical anymore. Skip the daily .50 cents and get your news online. And for you dedicated coupon clippers, you can get most of your Sunday coupons online now too.

Budgeting Tools -- There are many budgeting tools (both online and desktop) that offer up the service for free. Don't ask me how they do this, but who cares. If you're looking to reign in some of your spending, the good news is you can do it for free.

Pets -- This is a controversial one, I know. But there are likely many pets down at your local animal shelter that could use just as much love as the pure-bred types. There may be a small fee due to the shelter for shots and basic care, but you'll have your pet home without paying a mini-fortune.

Shipping -- If you like to buy online, you probably use coupons to get a percentage off of your purchase. Take your skills to the next level and look for coupons or promotion codes that offer free shipping. If in doubt, visit a site like www.freeshipping.org.

Checking Account -- Isn't it nice when a bank takes your money, lends it out to earn money, and then has the audacity to charge you for the service? What a joke. Checking should be free. If yours isn't free then move to one of the many banks that offers a checking account for free. And the same can be said for ATM fees, teller fees, and checks.

DVD Rentals -- Did you know that you can rent DVDs from RedBox locations for $1 a night? And better yet, if you use one of the coupon codes from www.insideredbox.com you can avoid the $1 charge. Free DVD rentals! Most libraries now have free DVD rental as well.

Exercise -- Skip the expensive gym memberships. Visit your local park for a walk or run. Do basic push-up and sit-up programs in your living room. Rent a workout DVD from the library. There are many free workout programs you can download online as well.

Can you think of any other things you should be getting for free? Leave your suggestions in the comments below.

Thursday, August 19, 2010

So much money and energy is wasted on things we could get for free. If you're into new, shiny things and collecting stuff, this is not for you. But if you want less clutter in your life and want to keep more of your money, then check out these 15 things you shouldn't be paying for.

Basic Computer Software -- Thinking of purchasing a new computer? Think twice before you fork over the funds for a bunch of extra software. There are some great alternatives to the name brand software programs. The most notable is OpenOffice, the open-source alternative to those other guys. It's completely free and files can be exported in compatible formats.

Your Credit Report -- You don't have to pay for your credit report. You could sign up for one of the free credit monitoring services online to get a quick look at your credit report. You just have to remember to cancel the service before the end of the free trial. Or you could do one better and visit www.annualcreditreport.com, the only truly free place to see all three of your credit reports for free once a year.

Cell Phone -- The service plan may be expensive, but the phone itself doesn't have to cost a thing. Most major carriers will give you a free phone, even a free smart phone, with a two-year contract.

Books -- There's a cool place in your town that's renting out books for free: the library. Remember that place? Stop by and put your favorite book on reserve. And if you don't feel like getting out, visit www.paperbackswap.com and find your books there (small shipping fees apply).

Water -- Besides the monthly utility bill, there's no reason to shell out $1 for every bottle of water you drink. Bottled water is so last decade anyway. We're over it, and into tap, filters, and reusable water bottles. It's cheaper for you and better for the environment.

Credit Card -- With as many credit cards as there are available on the market today, it's easy to avoid a credit card with an annual fee. Unless you're dead set on a particular perk that a fee card brings, skip the annual fee card and pocket that money yourself.

Debt Reduction Help -- Speaking of credit cards, if you're in over your head with credit card help, there are many free sources you can turn to for help with your debt. No one is going to be able to magically wipe away your debts, but there is help out there that will set you up on a debt reduction plan you can handle. Start with a visit to the National Foundation for Credit Counseling.

Basic Tax Preparation -- If your tax situation isn't that complicated, then you should probably be preparing your own tax return using one of the many free online services. It's now common for e-filing to be free as well with many services. You won't even need a stamp.

The News -- Leave it to a blogger to try and kill off traditional print. I'm not anti-newspaper. I just don't find them practical anymore. Skip the daily .50 cents and get your news online. And for you dedicated coupon clippers, you can get most of your Sunday coupons online now too.

Budgeting Tools -- There are many budgeting tools (both online and desktop) that offer up the service for free. Don't ask me how they do this, but who cares. If you're looking to reign in some of your spending, the good news is you can do it for free.

Pets -- This is a controversial one, I know. But there are likely many pets down at your local animal shelter that could use just as much love as the pure-bred types. There may be a small fee due to the shelter for shots and basic care, but you'll have your pet home without paying a mini-fortune.

Shipping -- If you like to buy online, you probably use coupons to get a percentage off of your purchase. Take your skills to the next level and look for coupons or promotion codes that offer free shipping. If in doubt, visit a site like www.freeshipping.org.

Checking Account -- Isn't it nice when a bank takes your money, lends it out to earn money, and then has the audacity to charge you for the service? What a joke. Checking should be free. If yours isn't free then move to one of the many banks that offers a checking account for free. And the same can be said for ATM fees, teller fees, and checks.